carbon tax benefits and disadvantages

It imposes expensive administration costs. Effects of a Carbon Tax on the Economy and the Environment.

Carbon Tax Or Cap And Trade David Suzuki Foundation

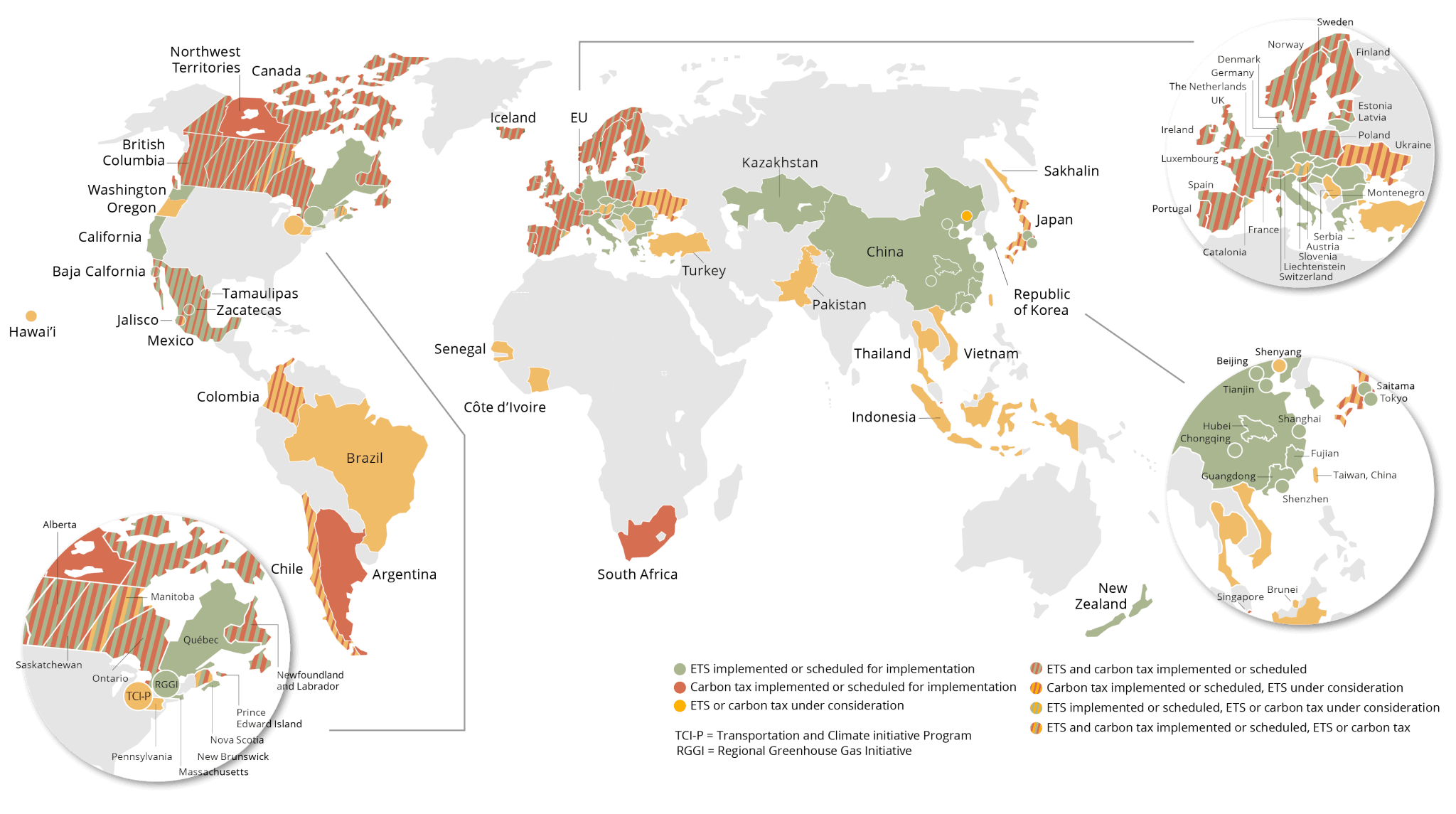

Federal carbon tax and 16 also falls within their range.

. Critics focus on certain disadvantages of carbon taxes or cap-and-trade but their arguments are unpersuasive if policies are well-designed. The carbon tax can be regarded as the price for one unit of carbon that is emitted into our atmosphere. A carbon tax on fossil fuels is often regressive in its impact - hurting poorer people relatively more than richer ones Image.

It helps environmental projects that cant secure funding on their own and it gives businesses. A carbon tax could force businesses and citizens to cut back carbon-intensive services and goods. It is a form of carbon pricing and aims to reduce global carbon emissions in.

High burden of compliance. Another disadvantage to be discussed is the above highlighted point because three tax returns must be filed each month the compliance rate for. For example 16 is 6 higher than the recent auction value of Californias cap-and-trade allowances for 2015 but about 13.

A carbon tax also has one key advantage. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price. Up to 24 cash back List of Disadvantages of Carbon Tax 1.

A carbon tax might lead me to insulate my home or refrain. The proponents claim this would be easy to administrate as there are already special taxes in place in the energy sector that can be used as the foundation to the. While a carbon tax does not offer.

Carbon offsetting has benefits at both ends of the process. One of the advantages of using carbon tax is that it represents a quantifiable source of revenue generation that can be controlled by government along with providing. The Pros of Carbon Offsetting.

It could start a race for lower emissions technologies which. A carbon tax provides certainty about the price but little certainty about the amount of emissions reductions. It is easier and quicker for governments.

The carbon tax can be really expensive considering that the government. A carbon taxs effect on the economy depends on how lawmakers would use revenues generated by the tax.

What Would Be The Benefits And Drawbacks Of The U S Implementing A Carbon Tax Homework Study Com

Carbon Tax Pros And Cons Economics Help

Pragmatism Over Purism How To Design A Carbon Tax To Win Political And Social Support Iiea

Distributional Effects Of Carbon Taxation Sciencedirect

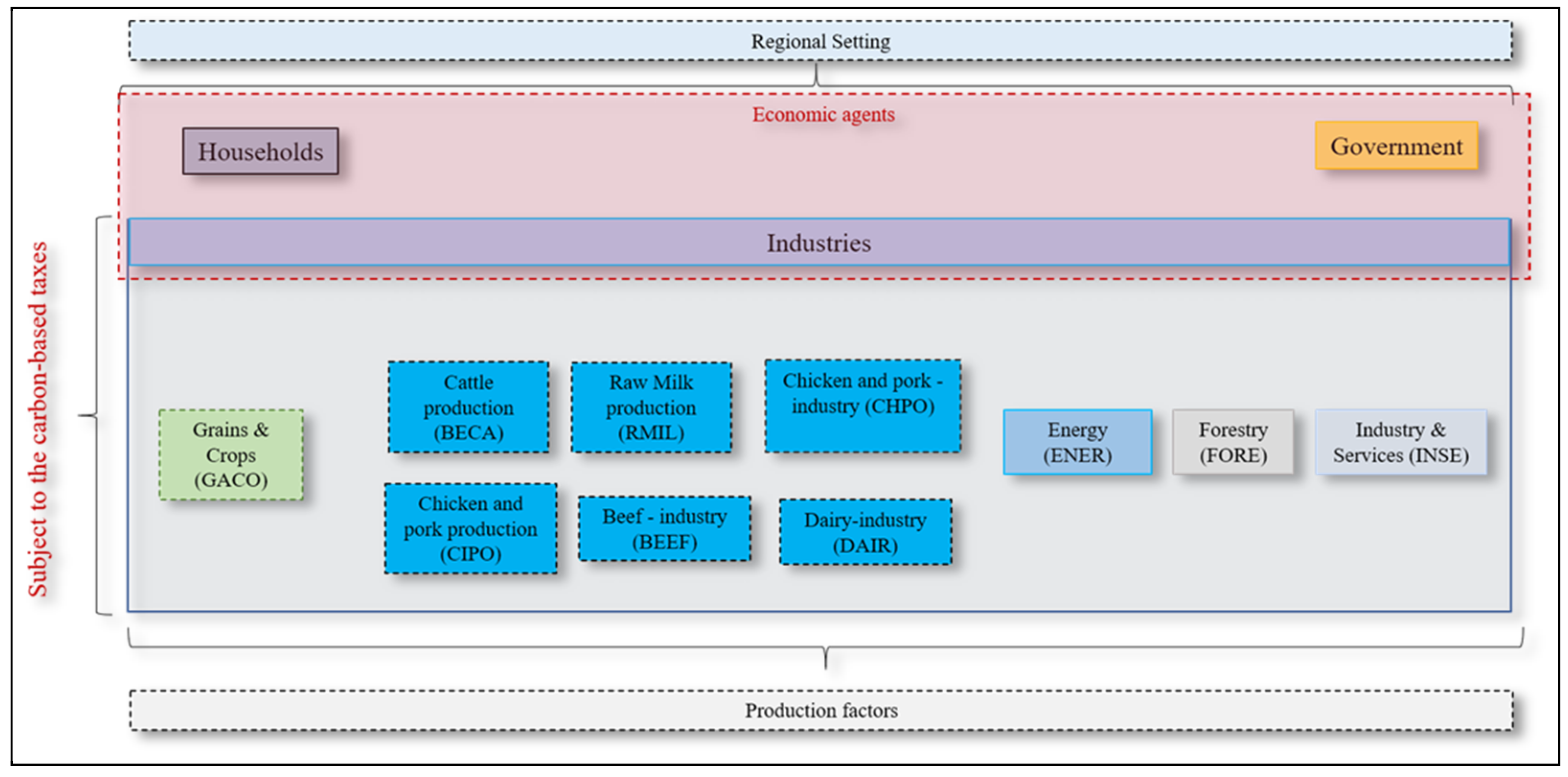

Sustainability Free Full Text Climate Change Policies And The Carbon Tax Effect On Meat And Dairy Industries In Brazil Html

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Carbon Tax What Are The Pros And Cons Climateaction

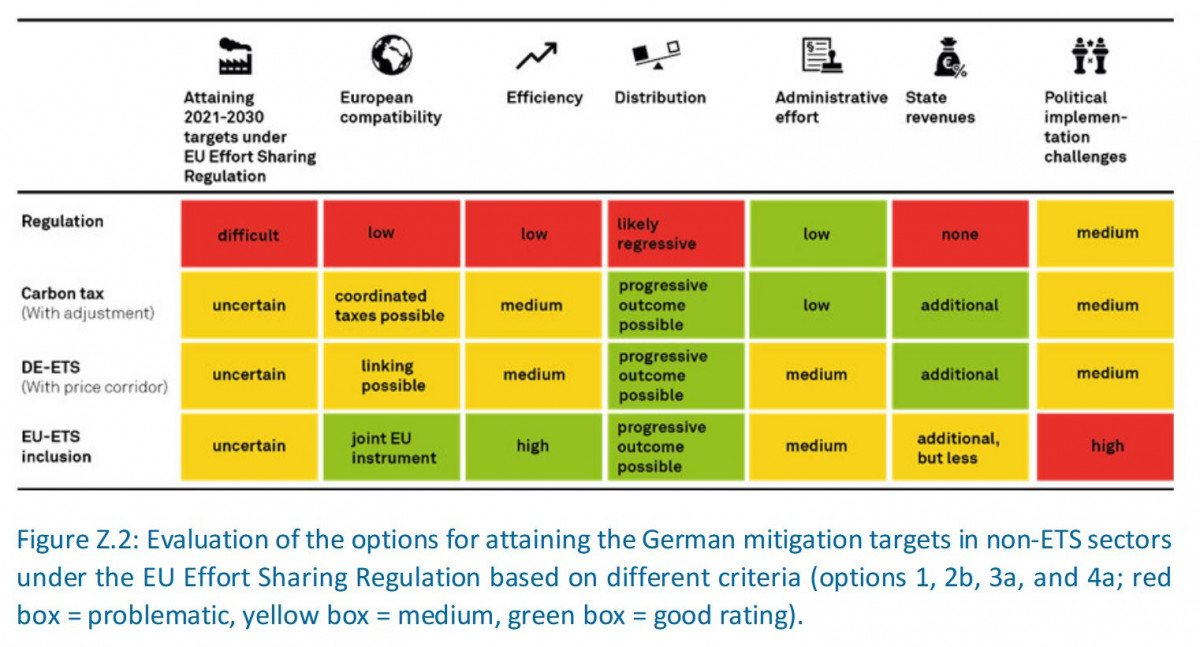

Putting A Price On Emissions What Are The Prospects For Carbon Pricing In Germany Clean Energy Wire

Carbon Tax Basics Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

What Are The Pros And Cons Of A Carbon Tax Elawtalk Com

Carbon Pricing In Canada Wikipedia

Reckless Or Righteous Reviewing The Sociotechnical Benefits And Risks Of Climate Change Geoengineering Sciencedirect

.png)

Would A Green New Deal Add Or Kill Jobs Scientific American

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

/GettyImages-97615566-5b58f1ddc9e77c00713cdd3c.jpg)